Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid. Measures to develop China’s https://currency-trading.org/software-development/digital-architect/ derivative market also boosted interest in hedging, Ma said. That brings the number of listed firms that announced hedging arrangements in the first half to more than 1,000, almost matching last year’s total of 1,133, according to risk-management consultancy D-Union.

To give you an example, in a totally hedged trading account, the volume is equal on both the long and short sides of the same currency pair. Therefore, at one moment in time, it is possible to have two lots on the long side of the EUR/USD pair, and two lots on the short side of the same currency pair. At first glance, this seems like a stupid thing to do; I mean, why trade the same pair in both directions, as eventually one is going to end up in a loss, right? The answer comes from the fact that the market does not move in locked steps, but in waves, and corrections are expected after a swing higher or lower happens. Another answer is the fact that some trades may be the result of a specific timeframe analysis, and others the result of a different one; and both might make sense at a specific moment in time. What is different is the time horizon, or the moment at which the take profit is supposed to be reached.

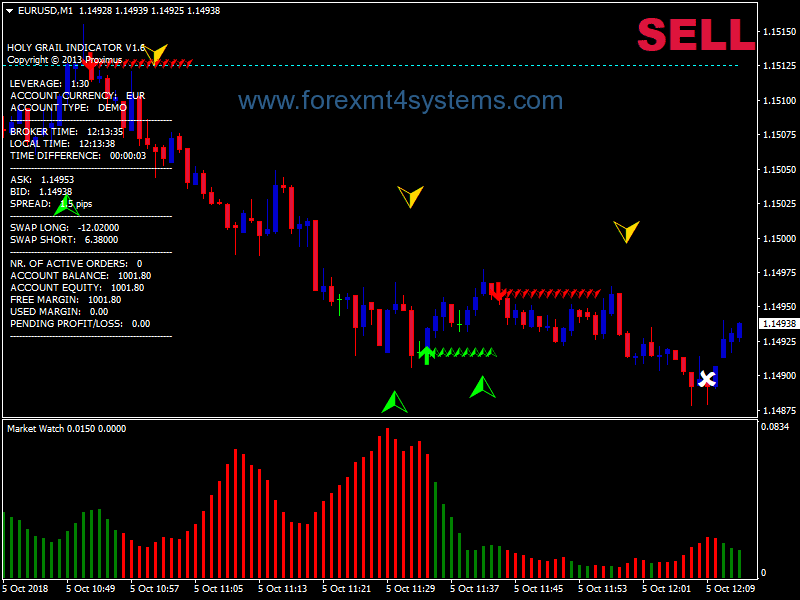

Forex hedging example

Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. If – at the time of expiry – the price has fallen below $0.75, you would have made a loss on your long position but your option would be in the money and balance your exposure. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion.

This type of hedging is done by opening an opposite position on the same pair. For example, let’s say that you are trading the EUR/USD currency pair, and you see that the market is not going as you have anticipated. In addition to currency pairs, this global broker provides https://trading-market.org/bullish-harami-definition/ access to more than 250 tradable instruments including CFDs, indexes, bonds, ETFs and cryptocurrencies. Using a hedge is often more controversial when your underlying position or exposure ultimately turns out to benefit from the exchange rate movement seen afterward.

Analyzing Forex Factory News: Tips for Making Informed Trading Decisions

Forex beginners are always eager to learn forex trading online as an opportunity to make money, and they always wonder how to get started. Some traders find that hedging forex with automated trading tools, or robots, is beneficial for obvious reasons. Automated trading tools do the majority of the work for the trader once set up.

This opportunity loss r could reduce competitiveness for a business due to the loss you’ll need to take on a hedge. Because there are so many different types of options and futures contracts, an investor can hedge against nearly anything, including stocks, commodities, interest rates, or currencies. In this case, removing the hedge allows you to collect the full profits of your successful trade. Finally, you may want to remove your hedge in order to lower the costs of hedging. It’s important to note that this kind of hedging is not allowed in the United States, and you should generally be familiar with U.S. forex regulations. The opening of a contrary position is regarded as an order to close the first position, so the two positions are netted out.

When the order loss is too much, you can reduce the loss by hedging

The charts above show that while the USD/CHF increased between May 21 and November 25, the EUR/USD declined. If you were short on USD/CHF, you would have limited your risks by taking a short position on EUR/USD. If the USD strengthens, the gains from the short position in the GBP/USD will offset some of the losses from the long position in the EUR/USD. In this scenario, you could hedge your long position in the EUR/USD by taking a short position in the GBP/USD. For example, let’s say you’ve gone long on the EUR/USD currency pair, but you’re starting to get nervous about potential downside risks. Another situation where you may use forex hedging is when you are uncertain about the market’s direction.

Indian importers must hedge near-term exposures on dollar-rally risk … – Reuters

Indian importers must hedge near-term exposures on dollar-rally risk ….

Posted: Thu, 29 Jun 2023 07:00:00 GMT [source]

A U.S. company (Party A) is looking to open up a €3 million plant in Germany, where its borrowing costs are higher in Europe than at home. Assuming a 0.6 euro/USD exchange rate, the company can borrow €3 million at 8% in Europe or $5 million at 7% in the U.S. The company borrows the $5 million at 7% and then enters into a swap to convert the dollar loan into euros.

What is the best hedging strategy in forex?

That might be because you suspect your assets have been over-purchased, or you see political and economic instability in the region of your currency. This is called forex hedging, and as you https://day-trading.info/beginners-guide-to-vantage-fx-review-2020/ can see the gains from your second position will offset the expected losses from your first position. This allows you to maintain your first position while still reducing your losses.

- For example, EUR/USD has been setting high highs and lows as the confidence in the dollar swings back and forth.

- The net profit of a direct hedge is zero, traders have to retain the authentic position on the market adjusted for when the trend reversals.

- Forex beginners are always eager to learn forex trading online as an opportunity to make money, and they always wonder how to get started.

While you have the opportunity to let the option expire without any additional payments, you will be losing the premium that you had paid initially. As a result, if you have a long position on EUR/USD opened, and you open a short position on the same pair, the broker is required to close the first position. Forex hedging is usually done using spot contracts, Forex options, currency futures, and CFDs. Hedging in Forex is typically a long-term strategy that aims at reducing losses by opening one or more positions, thus offsetting already existing ones.